In the intricate world of ESG audits, particularly in areas as critical as social compliance and human rights, preparation is more than just a preliminary step; it is the foundation upon which the entire audit process is built. This foundational phase determines the effectiveness of the audit, the accuracy of its findings, and, ultimately, the capacity to drive meaningful change within organizations. ESG auditors, therefore, must cast a wide net, gathering data from a variety of sources to paint a comprehensive picture of the organization’s practices before they even set foot on site. This blog delves into the significance of thorough preparation for ESG audits and explores the rich tapestry of data sources that auditors can tap into, ranging from certification bodies (CB) and client-provided data to auditors’ own research and stakeholder consultations.

The Cornerstone of Audit Success: Meticulous Preparation

At the heart of every successful audit lies meticulous preparation. This phase is about equipping oneself with a thorough understanding of the audit scope, the relevant standards and regulations, and the specific context of the organization under scrutiny. It involves not just a review of documents but a holistic gathering of intelligence that will inform the audit strategy. Proper preparation allows auditors to identify key areas of focus, tailor their questioning, and anticipate challenges, ensuring that the audit not only identifies non-compliance but also uncovers the root causes of issues and opportunities for improvement.

Diverse Data Sources: A Multifaceted Approach

The complexity of ESG audits necessitates a multifaceted approach to data gathering. Auditors must leverage a variety of sources, each offering unique insights and perspectives that are crucial for a well-rounded audit preparation.

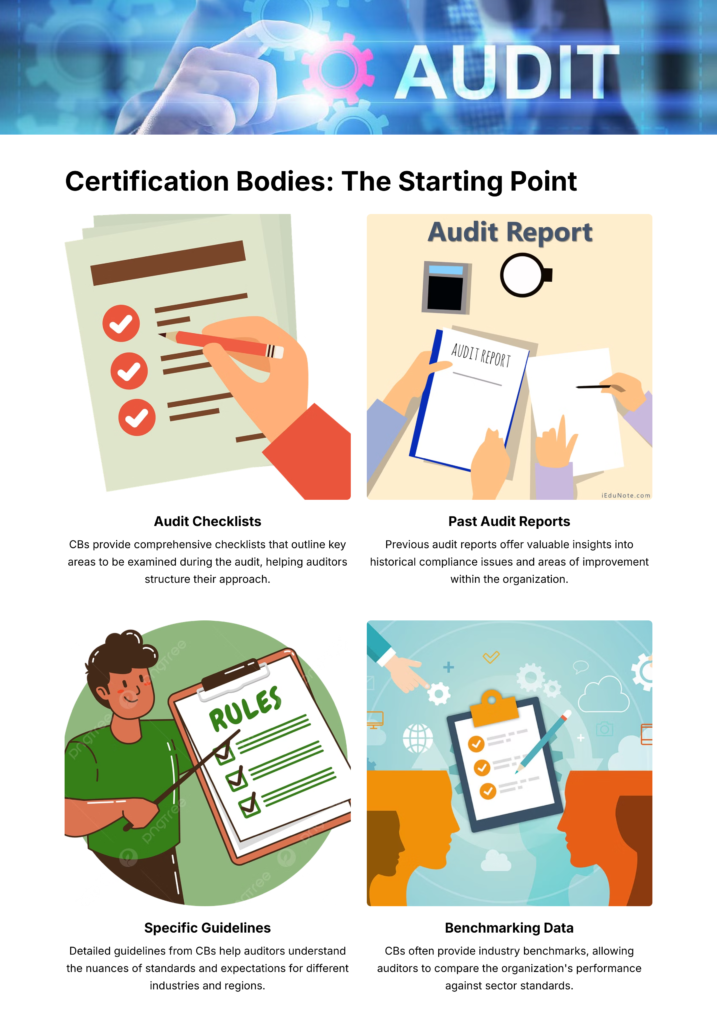

1. Certification Bodies (CB): A Starting Point

These organizations may be named differently, such as certification bodies (CB), conformity assessment bodies (CAB), validation and verification bodies (VVB) or auditing firms – organizations that conduct certification or conformity assessments. They are a treasure trove of information for auditors. They often provide audit checklists, past audit reports, and specific guidelines that can shape the auditor’s understanding of the standards and expectations. Reviewing the resources and data provided by CBs helps auditors grasp the formal requirements and benchmarks against which the organization’s practices will be evaluated.

2. Client-Provided Data: The Inside View

Data requested from the client, such as employee records, policies, procedures, and previous audit reports, offers an insider’s view of the organization’s compliance landscape. This information serves as a baseline for auditors, helping them identify potential areas of risk, compliance, and non-compliance. It also allows auditors to tailor their audit plan to the organization’s specific context, ensuring a more targeted and effective audit process.

3. Auditors’ Own Research: Broadening the Horizon

Beyond the information provided by CBs and clients, auditors’ own research is pivotal. This involves exploring the organization’s public records, industry reports, news articles, and other relevant publications. Such research can uncover broader issues within the industry, regional compliance challenges, or specific concerns related to the organization that might not be immediately apparent from internal documents. This broader perspective is invaluable for understanding the context in which the organization operates and for preparing questions that probe deeply into systemic issues.

4. Outreach/Consultation: Engaging with Stakeholders

Finally, outreach and consultation with stakeholders such as workers, trade unions, local communities, and non-governmental organizations (NGOs) offer unique insights that cannot be gleaned from documents alone. These interactions can reveal the lived experiences of individuals affected by the organization’s practices, highlight areas of concern that may not be documented, and provide a nuanced understanding of the organization’s social compliance and human rights impacts. Engaging with stakeholders ensures that the audit considers a wide range of perspectives, enriching the audit process with firsthand accounts and experiences.

The Impact of Comprehensive Preparation

Thorough preparation, informed by a diverse set of data sources, sets the stage for an audit that is not only comprehensive and effective but also transformative. By gathering data from certification bodies, client-provided documents, their own research, and stakeholder consultations, auditors equip themselves with a multidimensional understanding of the organization’s practices. This preparation enables auditors to conduct focused interviews, make informed observations, and ultimately, provide recommendations that are both insightful and actionable.

In conclusion, the road to a successful social compliance and human rights audit is paved with detailed preparation. Auditors must embrace a holistic approach to data gathering, drawing on a wide array of sources to inform their strategy. This meticulous preparation is the key to unlocking audits that do more than just identify non-compliance; they spark change, driving organizations towards more ethical, responsible, and compliant practices.